Forex trading, also known as international change trading, involves the getting and offering of currencies on the international change industry with the goal of earning a profit. It’s the largest economic market internationally, by having an average everyday trading size exceeding $6 trillion. Forex trading presents investors and traders the chance to suppose on the fluctuation of currency rates, allowing them to probably benefit from changes in trade rates between various currencies.

One of the crucial top features of forex trading is its decentralized character, since it operates 24 hours a day, five days weekly across different time areas worldwide. This supply allows traders to participate on the market anytime, giving sufficient options for trading across the clock. Additionally, the forex industry is highly fluid, and therefore currencies can be bought and sold quickly and easily without significantly affecting their prices.

Forex trading involves the utilization of control, which allows traders to regulate greater jobs with a lesser amount of of capital. While influence can enhance profits, additionally, it raises the risk of deficits, as also little fluctuations in currency rates can lead to significant gets or losses. Thus, it is essential for traders to control their chance cautiously and use correct risk administration techniques, such as setting stop-loss instructions and diversifying their trading portfolio.

More over, forex trading provides a wide variety of trading strategies and methods, including specialized evaluation, fundamental examination, and message analysis. Technical evaluation requires studying historical value information and using different signs and chart patterns to recognize trends and estimate potential price movements. Simple examination, on one other hand, is targeted on examining economic signs, news functions, and geopolitical developments to measure the intrinsic value of currencies. Belief analysis requires gauging market feeling and investor conduct to assume adjustments in industry sentiment.

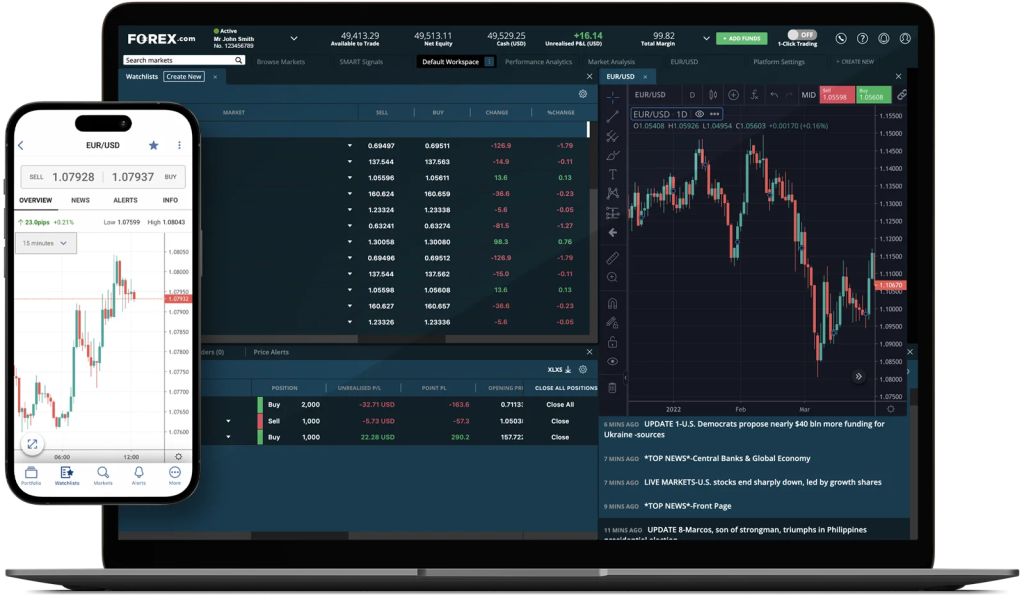

More over, developments in technology have converted the landscape of forex trading, rendering it more available and efficient than ever before. On line trading platforms and mobile applications allow traders to perform trades, accessibility real-time market knowledge, and check their positions from everywhere with a web connection. Additionally, automatic trading systems, such as for example specialist advisors (EAs) and trading robots, can execute trades quickly based on pre-defined conditions, eliminating the necessity for manual intervention.

Despite their potential for profit, forex trading provides natural dangers, and traders must be familiar with the pitfalls and difficulties connected with the market. Volatility, geopolitical events, and sudden market movements can lead to considerable failures, and traders should forex robot be prepared to handle these dangers accordingly. Furthermore, cons and fraudulent actions are prevalent in the forex industry, and traders should exercise caution when selecting a broker or expense firm.

In conclusion, forex trading provides a vibrant and possibly lucrative opportunity for investors and traders to be involved in the international currency markets. Having its decentralized character, high liquidity, and supply, forex trading is now significantly popular among people seeking to diversify their expense account and capitalize on currency value movements. But, it is required for traders to teach themselves about the marketplace, develop a solid trading program, and practice disciplined risk management to succeed in forex trading over the long term.