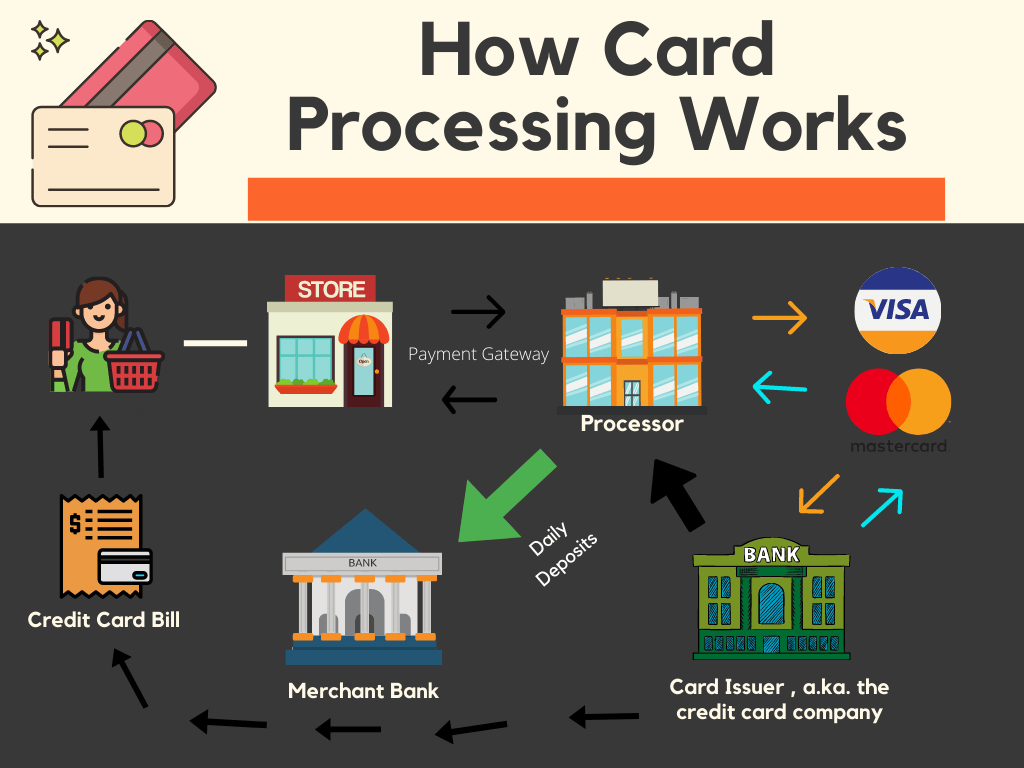

A bank card cost processor represents a pivotal role in the modern financial landscape, serving because the linchpin that facilitates electric transactions between vendors and customers. These processors act as intermediaries, connecting businesses with the banking process and allowing the seamless transfer of funds. The essence of the function lies in translating the data from a charge card exchange in to a language clear by economic institutions, ensuring that funds are approved, prepared, and resolved efficiently.

One of many primary features of a credit card payment processor is always to enhance the effectiveness of transactions. Whenever a client swipes, inserts, or shoes their bank card, the payment model rapidly assesses the transaction details, communicates with the applicable economic institutions, and validates perhaps the purchase can proceed. This process does occur in a subject of seconds, focusing the speed and real-time nature of bank card cost processing.

Security is just a paramount matter in the kingdom of economic transactions, and credit card payment processors are at the forefront of employing actions to guard painful and sensitive information. Sophisticated encryption systems and conformity with business criteria make certain that customer data remains secure through the cost process. These protection steps not only safeguard customers but also generate rely upon businesses adopting electric cost methods.

The bank card cost control ecosystem is continually growing, with processors changing to technical advancements and adjusting customer preferences. Cellular obligations, contactless transactions, and the integration of electronic wallets represent the forefront of creativity in this domain. Credit card payment processors play a crucial role in enabling businesses to keep forward of these styles, providing the infrastructure needed to aid diverse payment methods.

Beyond the standard brick-and-mortar retail room, charge card payment processors are crucial in running the large landscape of e-commerce. With the increase of on the web searching, processors facilitate transactions in a virtual atmosphere, managing the complexities of card-not-present scenarios. The ability to effortlessly navigate the complexities of electronic commerce underscores the adaptability and flexibility of credit card cost processors.

International commerce relies heavily on bank card payment processors to help transactions across borders. These processors handle currency conversions, handle global compliance demands, and make certain that businesses may run on an international scale. The interconnectedness of economic systems, reinforced by bank card cost processors, has developed commerce right into a really borderless endeavor.

Credit card cost processors lead considerably to the development and sustainability of little businesses. By offering digital payment possibilities, these processors enable smaller enterprises to increase their customer bottom and contend on an even enjoying subject with bigger counterparts. The accessibility and affordability of charge card cost control companies have grown to be important enablers for entrepreneurial ventures.

The landscape of credit card cost running also involves criteria of scam reduction and regulatory compliance. Cost processors apply robust measures to identify and prevent fraudulent actions, guarding both businesses and consumers. Furthermore, keeping abreast of ever-evolving regulatory requirements ensures that transactions abide by legal standards, reinforcing the become a payment processor and integrity of the payment running industry.

In conclusion, charge card payment processors type the backbone of contemporary economic transactions, facilitating the clean movement of funds between firms and consumers. Their multifaceted position encompasses speed, safety, versatility to technological adjustments, and help for worldwide commerce. As engineering remains to improve and customer choices evolve, bank card payment processors can stay main to the vibrant landscape of digital transactions, surrounding the continuing future of commerce worldwide.